SETsquared is the number 1 incubator in the UK & Ireland

SETsquared, the number three start-up centre in Europe, follows a low-pressure approach to nurture a business.

Last year was tough for start-ups, globally, as the funds raised by venture capital groups — the main investors in fledgling companies — fell sharply because of rising interest rates, high inflation, and economic uncertainty.

In the UK — the biggest tech market in Europe — venture capital groups worldwide invested approximately $20bn in 2023, compared with about $37bn in 2022, according to an analysis of global VC funding published by professional services firm KPMG.

The tech industry more broadly suffered, too, as more than 250,000 jobs were cut across the sector, marking an end to its pandemic era boom.

As a result, the climate for UK investment in start-ups is “cooler” than in the past couple of years, but “not freezing”, says Garri Jones, co-head of a team at investment bank Lazard connecting investors with start-ups.

In the UK, there is still a well-established support network of start-up hubs to help young companies survive changes in the economic climate.

These hubs — geographic areas combining office space, research and development facilities, venture capital connections, and sources of advice — aim to provide the ideal conditions to help clusters of start-up companies grow.

Common programmes within hubs include three-month “accelerators”, to prepare a start-up for investment, or “incubators”, to nurture a young company over a couple of years. “Start-up hubs are getting better at what they do,” says Jones.

Campus-style hubs often rely on a pipeline of innovation from nearby universities, which create spin-off commercial ventures for promising science and technology research. But the structure of UK start-up hubs varies. Some are run not-for-profit by universities and other public-sector organisations, and others by investment companies.

However, successful hubs appear to have one factor in common: a facility for young businesses to network and swap advice. This collegiate approach is taken by SETsquared — the top-start-up hub in the FT-Statista ranking of UK and Irish hubs, and number three in Europe. It is run by six universities — Bath, Bristol, Cardiff, Exeter, Southampton and Surrey — in south-west and south-east England.

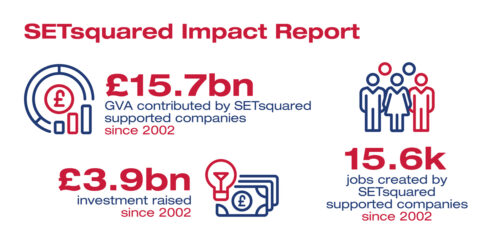

Since 2002, SETsquared says it has helped thousands of entrepreneurs raise £4.4bn in investment, “We’re probably slightly different to some of the cookie-cutter style accelerators as we have a very patient model,” says Marty Reid, Interim Executive Director at SETsquared.

“Probably owing to the fact that our origin is from universities and [the fact we] rely on a mix of public funding as well as private funding . . . we don’t have a model of pushing companies through, and out, the door.”

Even so, the low-pressure approach has delivered high financial returns. Since 2002, SETsquared says it has helped thousands of entrepreneurs raise £4.4bn in investment.

Among them is PsiQuantum, a quantum computing company spun out from research at the University of Bristol. In 2021, the company was valued at $3.15bn.

Hubs such as SETsquared, which QantX works with, try to overcome funding gaps by connecting investors with start-ups in one place, saving time. Experts say this can be especially useful for overseas investors who fly into a city for a day or two to meet promising businesses.

Harry Alexander, Investment Manager at QantX said “[SETsquared has] very good programmes to get investors like us to work with . . . and in front of, those companies. The hub helps start-ups understand their market and hone their marketing message, helping them become “investor ready”.

Credit: Financial Times

Related Articles

Count Published date12 October 2022

Published date12 October 2022  Published date13 June 2023

Published date13 June 2023

Published date7 February 2022

Published date7 February 2022

Published date13 June 2023

Published date13 June 2023

Published date16 November 2022

Published date16 November 2022  Published date10 November 2022

Published date10 November 2022

Published date9 March 2023

Published date9 March 2023  Published date4 July 2022

Published date4 July 2022  Published date14 July 2022

Published date14 July 2022

Published date9 April 2024

Published date9 April 2024  Published date3 February 2022

Published date3 February 2022